Unique Info About How To Apply For A Tin Card

Make it official—register a business with the industry leader in online business formation

How to apply for a tin card. Be one step ahead of your tin application by making sure. Ad get your tax id or ein with legalzoom®. On or before the commencement of business, or.

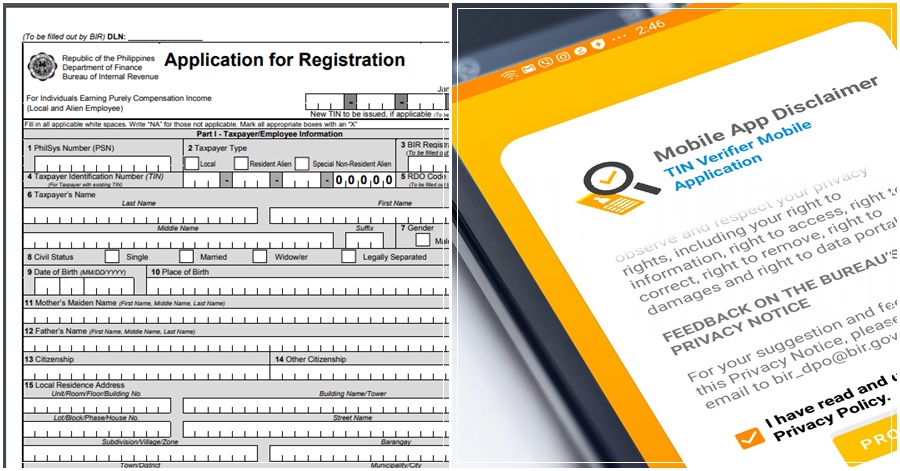

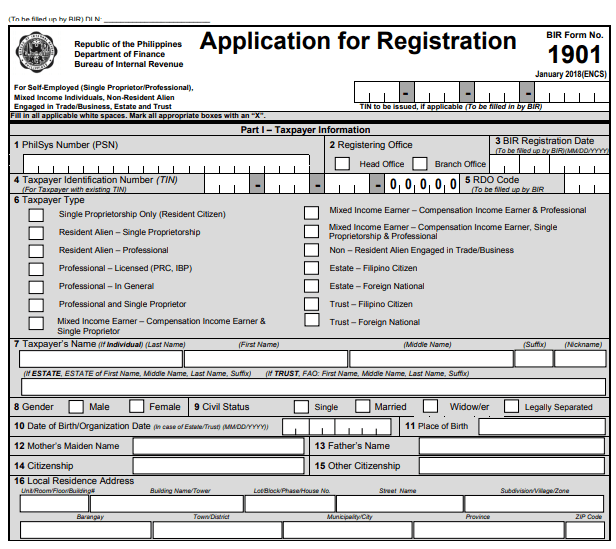

How to apply for a tin if you’re unemployed: If you already have a tin, simply go to the regional district office (rdo) where you are registered and apply. You can apply for a tin online, but if you want to get a tin id card, you still have to visit your respective rdo to claim it.

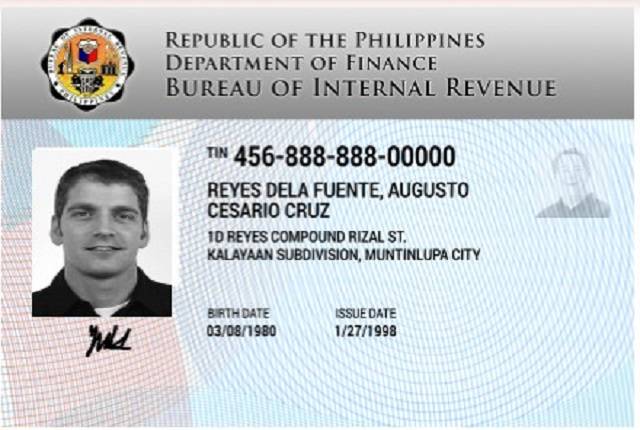

Further, requests for changes or correction in pan data or request for reprint of pan card (for an existing pan) may. The tin is the most important requirement to apply for an id card. Visit the bir rdo where your tin was issued.

Get a tax identification number (tin) get a physical tin id *the duration of the. Please refer to irs publication 1915 pdf (pdf) for a more detailed explanation of itins. If you already have a tin or tax identification number, the only step you have to do to get a tin id card is to go to the bir office where you were issued your tin, and then apply.

Prepare the bir requirements for tin registration. An individual taxpayer identification number (itin) is a tax processing number issued by the internal revenue service. How to get a tin id if you already have a tin.

Kindly go through the instructions and guidelines provided in the application form before filling the form. The irs issues itins to individuals who are required to have a u.s. A tin may be applied online at nsdl by a qualifying corporate organization.