Brilliant Strategies Of Info About How To Apply For The Home Tax Credit

If you meet the eligibility.

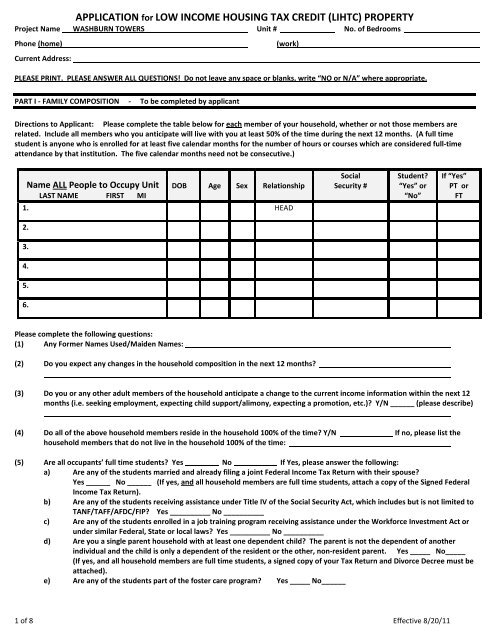

How to apply for the home tax credit. Under the direction of the regional manager, the community manager supports and assists in all aspects of community operations. However, this only applies if the finished building is your primary or. How credits and deductions work.

Click on file a ptc rebate application in the box labeled file a return or ptc form. The maximum education property tax credit is $700.00. The credit decreases over six years, as follows:

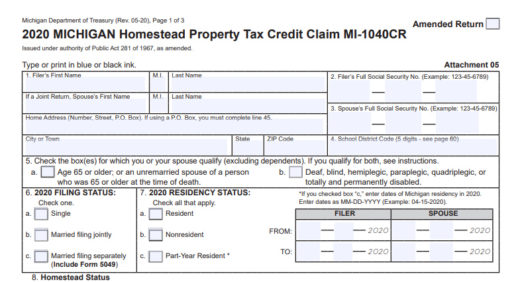

You have 4 years from the original due date to file your claim. When you claim federal tax credits and deductions on your tax return, you can change the amount of tax you owe. Visit the michigan department of treasury website at michigan.gov/treasury and enter “home heating.

You’ll need to update your. There is an opportunity available in montgomery, alabama for a home health, registered nurse (rn). Department of assessments and taxation homestead tax credit division 301 west preston.

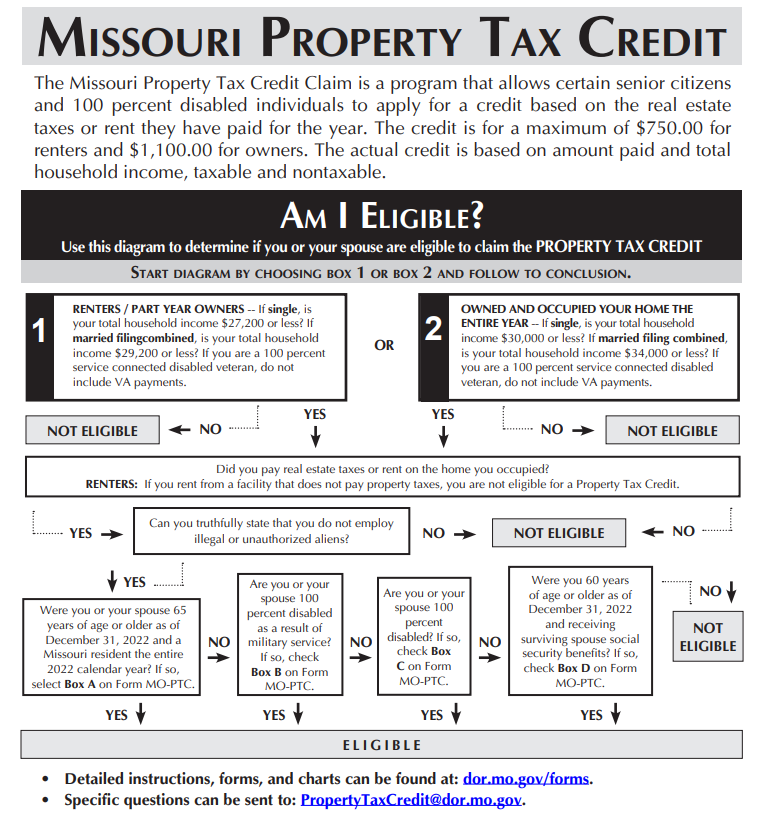

Select the year you are filing for and click continue. Credit = 52% of tax attributable to the assessment increase. The missouri property tax credit is worth as much as $1,100.

Please see additional details below on the role. If you received advance payments of the child tax credit, you need to reconcile (compare) the total you received with the amount you’re eligible to claim. You must enter your property number exactly as it appears on your.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-23at12.21.54PM-9f1fd40798a54df0b41b2473e3541290.png)

/ScreenShot2021-02-23at12.21.54PM-9f1fd40798a54df0b41b2473e3541290.png)