Outrageous Info About How To Avoid Taxes In Canada

.you can still start right now, acquire assets, get passive income and eventually, be able to avoid paying taxes because of the next tip.

How to avoid taxes in canada. 6 ways to avoid capital gains tax in canada. One of the cleanest ways to save yourself from capital gains tax in canada is to defer your earnings. Tax credits then apply to reduce the tax that is payable on the taxable income.

Wait until retirement if you’re nearing. For the 2022 tax year, the tfsa contribution limit is $6,000. 1) pay less personal taxes in canada 2) pay less business taxes in canada table of contents show how to pay less personal taxes in canada there are a number of.

So for example, say you made a $500 gain from selling eth and a $500 loss from selling btc, these. Keep your tax records for 6 years it's important to. Structure your investment accounts to place us stocks that pay.

The savings income tax ranges at progressive rates. You can offset capital losses against capital gains in canada to reduce your overall tax bill. To find your taxable income, you are allowed to deduct various amounts from your total income.

Dan's financial advisor carl goes over the secret strategies you can use to save tax money. Transfer ownership of your assets before you die. 30 ways to pay less income tax in canada for 2022.

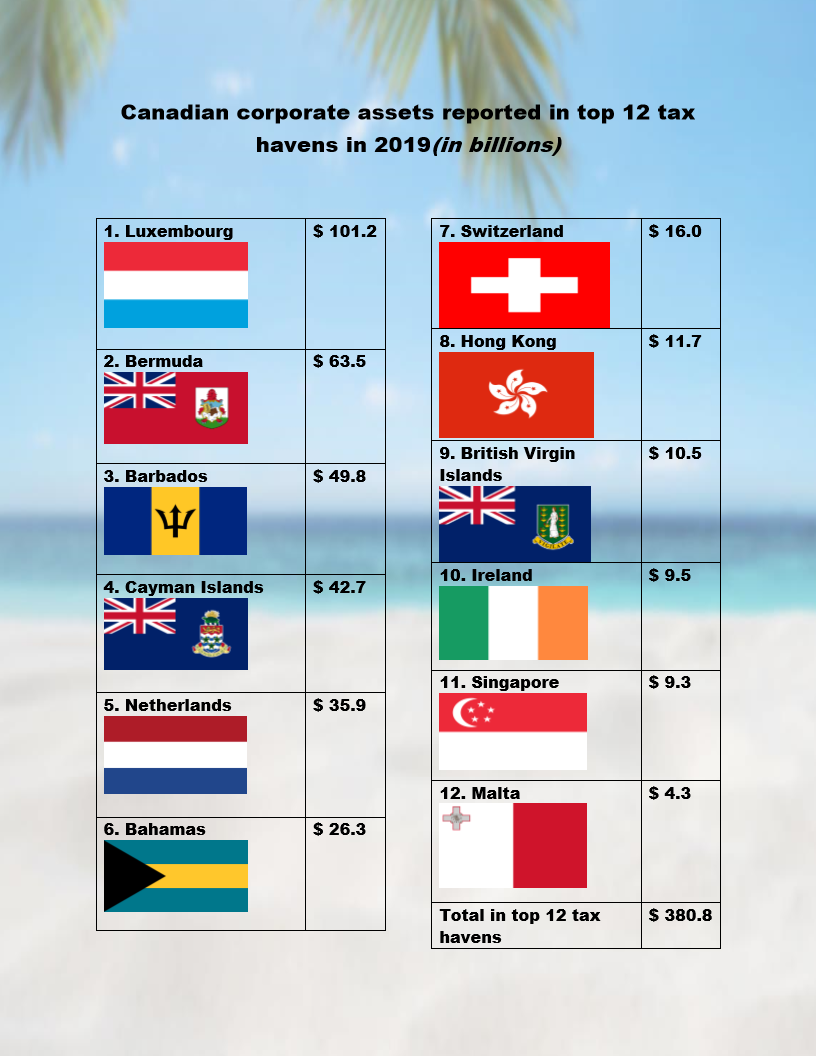

In other words, when you dispose of your crypto. How do we avoid this? How can rich people legally avoid paying taxes?

.jpg)

.jpg)

/https://www.thestar.com/content/dam/thestar/news/investigations/2022/04/09/this-tax-loophole-has-helped-rich-canadians-avoid-millions-in-taxes-for-their-private-corporations-now-the-government-wants-to-shut-it-down/canada_revenue_agency.jpg)

/images/2021/08/16/cryptocurrency-taxes.jpg)