Peerless Info About How To Buy Currency Futures

Tap on the button labeled “market” near the price chart.

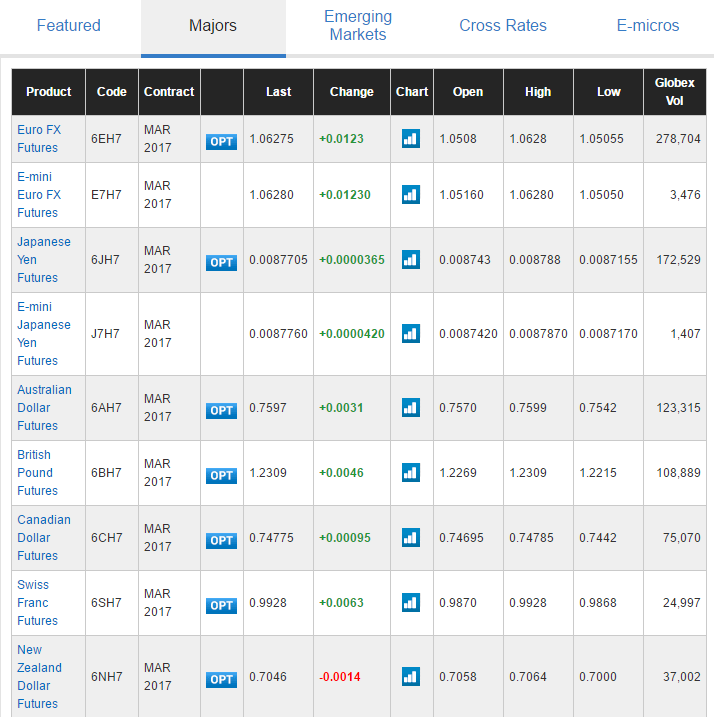

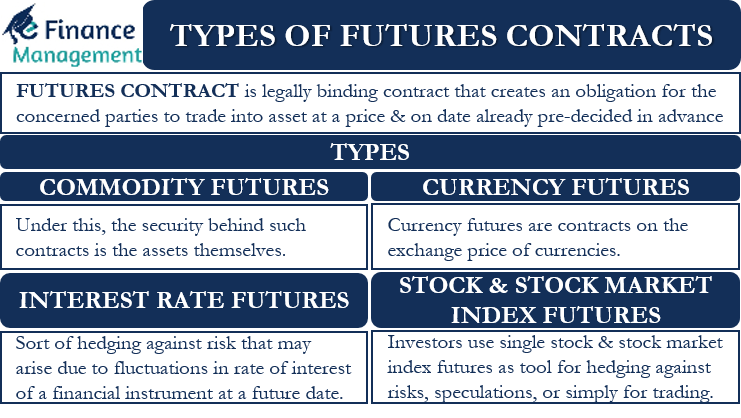

How to buy currency futures. Ad tools that can create, optimize, & automate any futures trading strategy. Currency futures are a transferable futures contract that specifies the price at which a currency can be bought or sold at a future date. Aside from the popular contracts such as the eur/usd (euro/u.s.

Deep liquidity and real time quotes from 17 of the world's largest fx dealers. Currency futures contracts are legally. The underlying asset for a currency future contract is always a.

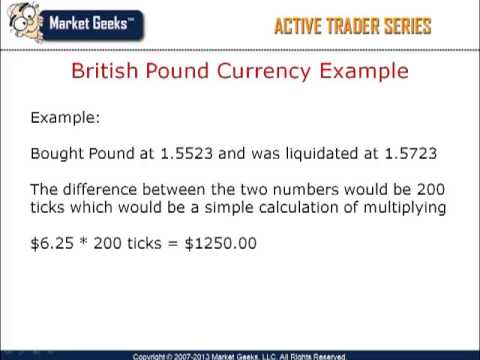

Using an online trade ticket for futures, enter the underlying symbol to find and select the specific futures contract you want to trade, then confirm the order details and submit the order. Currency futures move in increments called ticks, and each tick of movement has a value. Futures are financial contracts (agreements) giving the buyer an obligation to buy an asset and the seller an obligation to sell an asset at a predetermined price on a specified.

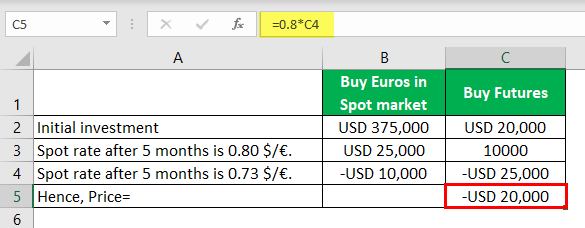

Conversely, we incur a $1,250 loss if we get stopped out. Tight spreads as narrow as 1/10 pip. Deposit margin money with your broker.

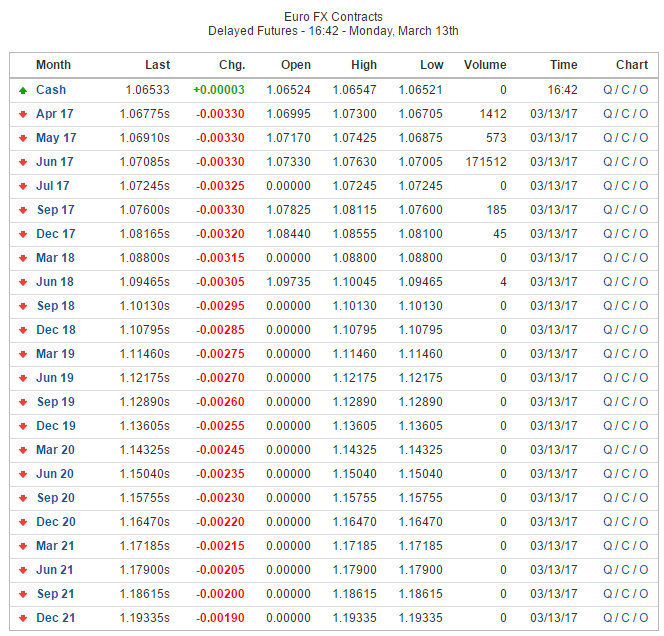

The margin money for your contract is the amount of money required to open the position (essentially, to purchase the contract). If the market moves in our favor and hits the order, we make a profit of $3,300 ($12.50 per tick x 264). 22 rows most of the currency futures contracts are traded on the chicago mercantile exchange (part of the cme group).

An fx futures or currency futures contract is a type of foreign exchange derivative, where a buyer agrees to buy one currency in exchange for another currency, at a future date. Instead of agreeing to buy foreign currency at a set price, they agree to buy their own domestic currency with the future proceeds of a sale made in a foreign currency.

:max_bytes(150000):strip_icc()/dotdash_INV_final_Currency_Futures_An_Introduction_Jan_2021-01-9e1617643f6847d59ae10ac414509721.jpg)

:max_bytes(150000):strip_icc()/dotdash_INV_final_Currency_Futures_An_Introduction_Jan_2021-02-34fd977f534c4bbe82a94b5f5868a558.jpg)

/dotdash_INV-final-An-Introduction-To-Trading-Forex-Futures-Apr-2021-01-6c3e908acab54d20a70a045c0e6dff0d.jpg)