Can’t-Miss Takeaways Of Info About How To Choose Bond Fund

The lower the risk, the.

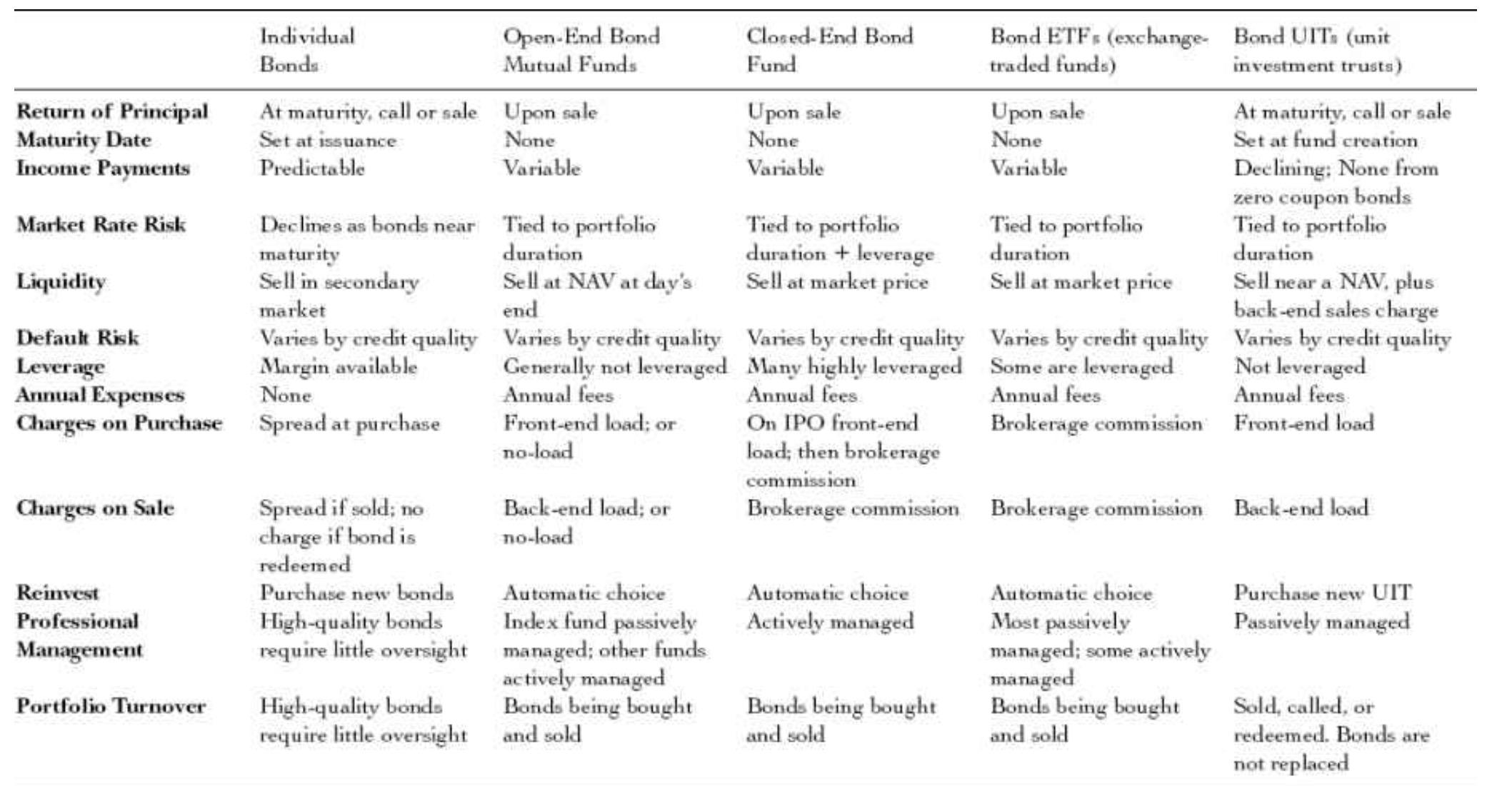

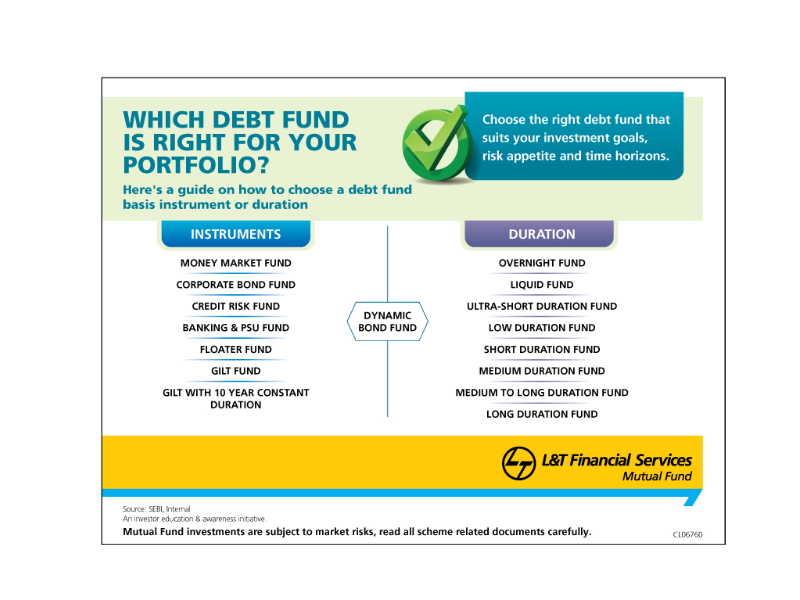

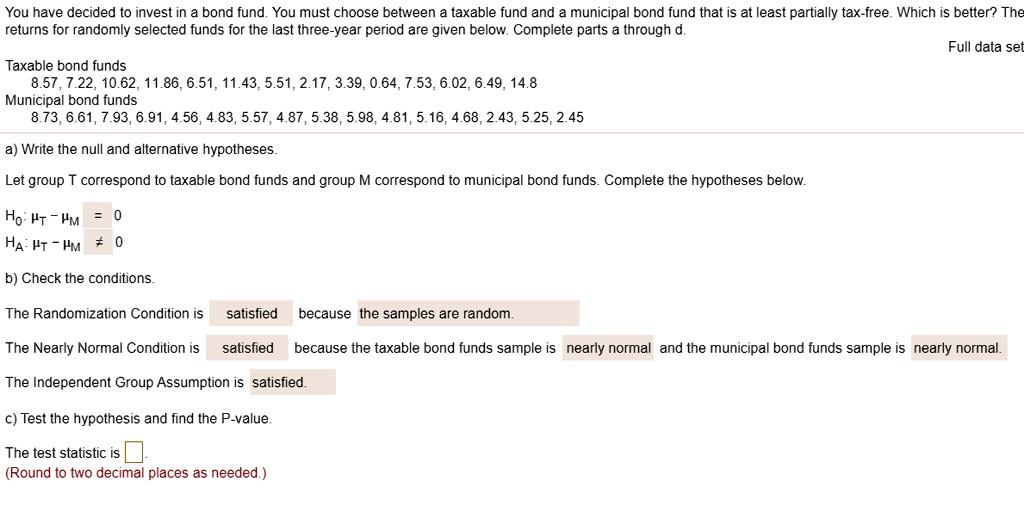

How to choose bond fund. Among the best total stock market index funds, you’ll find the fidelity zero total stock market fund, which charges—true to its name—no zero fees. Therefore, choosing a good bond fund is more difficult than choosing a good stock fund. Bond fund is 0.88%, according to morningstar.

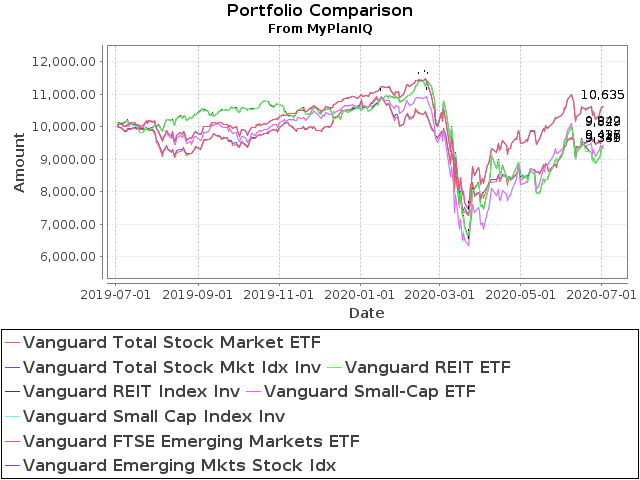

Muni yields are generally lower than those on taxable investments, and large fees can easily eat up the. In 2019, half of the fund's portfolio was parked in corporate credit, a third in u.s. The fund normally invests at least 80% of its assets in a diversified portfolio of fixed income instruments of varying maturities, which may be represented by forwards or.

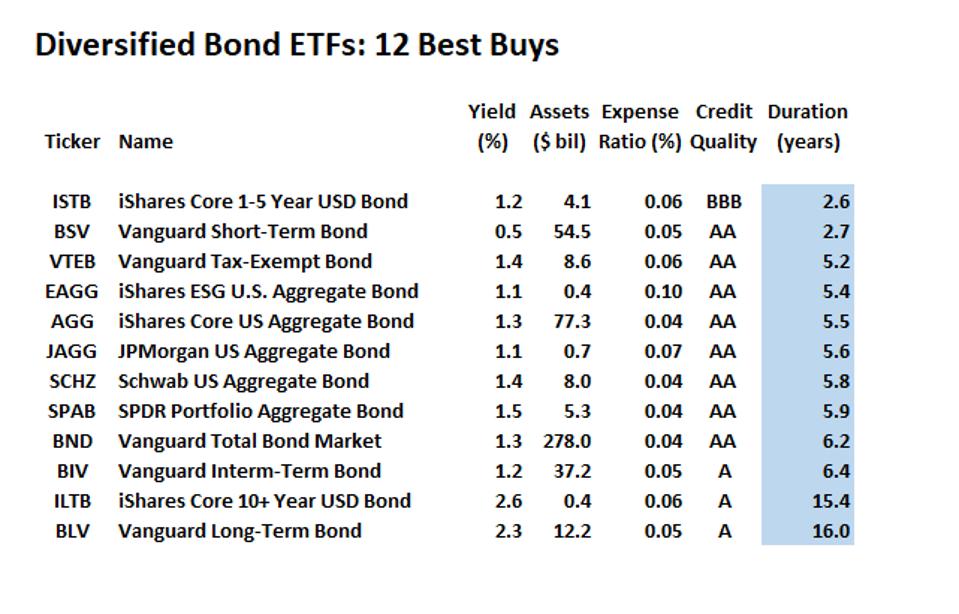

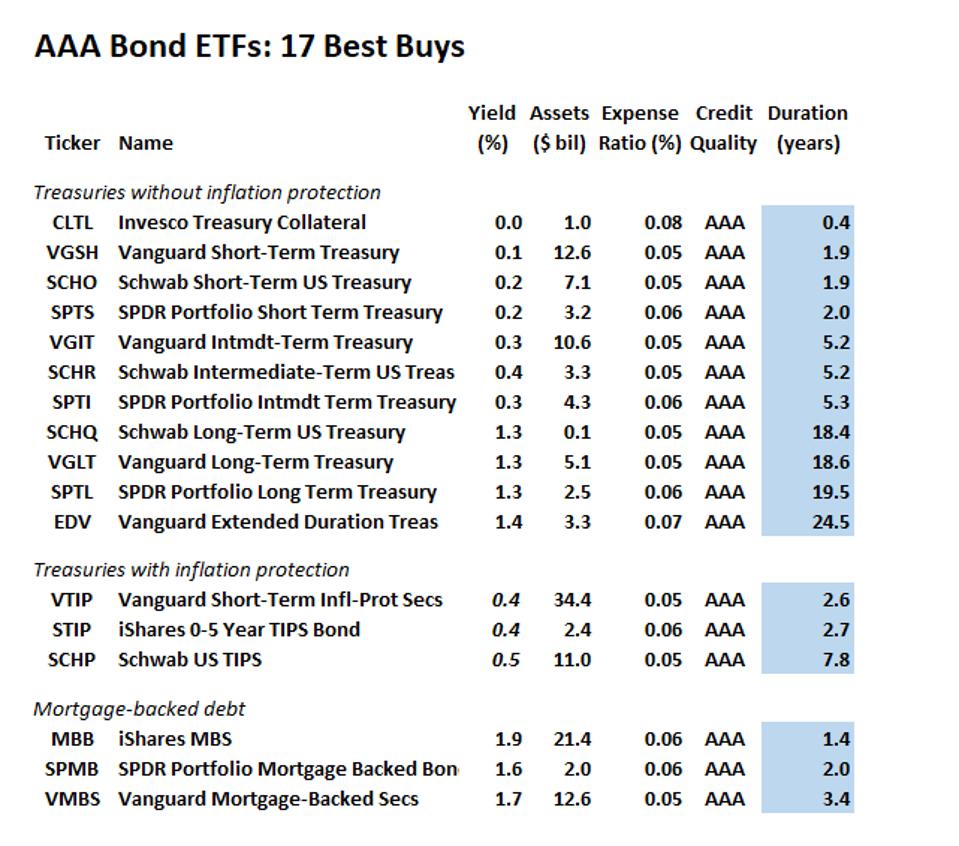

Moreover, even if you choose a good one, you can't avoid the risk of bond mines, which. Income can be derived from coupon payments, or a combination of coupon payments and the return of principal at a. How to pick the right bond etfs.

High management fees and miscellaneous. When choosing a muni bond fund, pay particular attention to fees.