Best Info About How To Find Out Vat Number

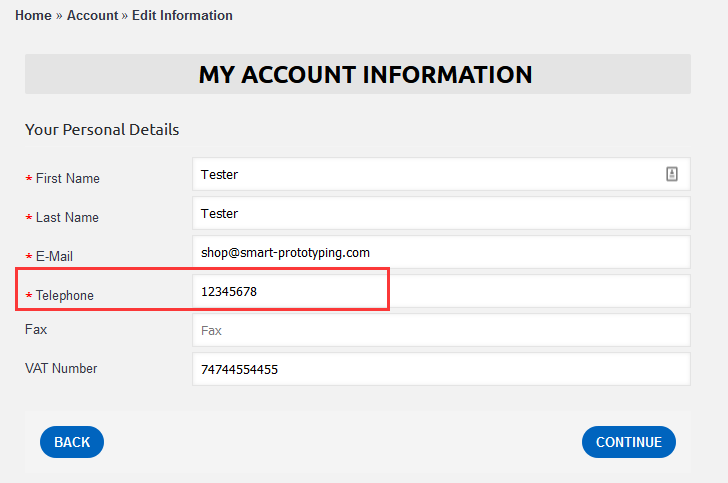

The first document to get the vat number of another business is to look at the invoices that are supplied to you.

How to find out vat number. To do so, select the document “vademecum on vat obligations” and the country in question. How can i check if a vat number is valid? You can now find the vat number of any business by using their commercial registration (cr) number on the zakat, tax and customs authority ( zatca) website.

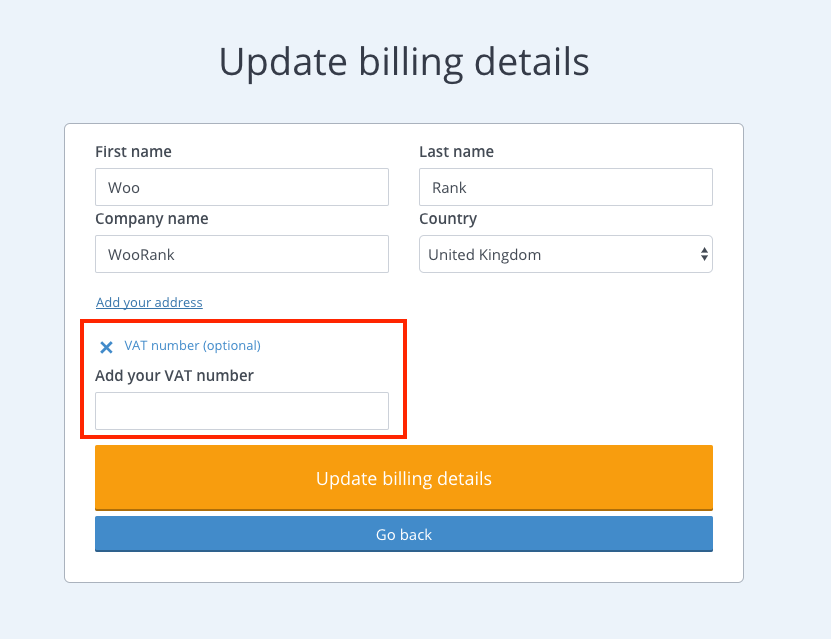

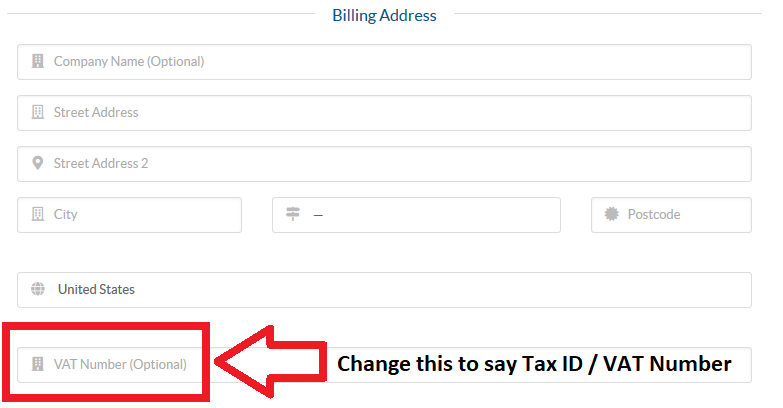

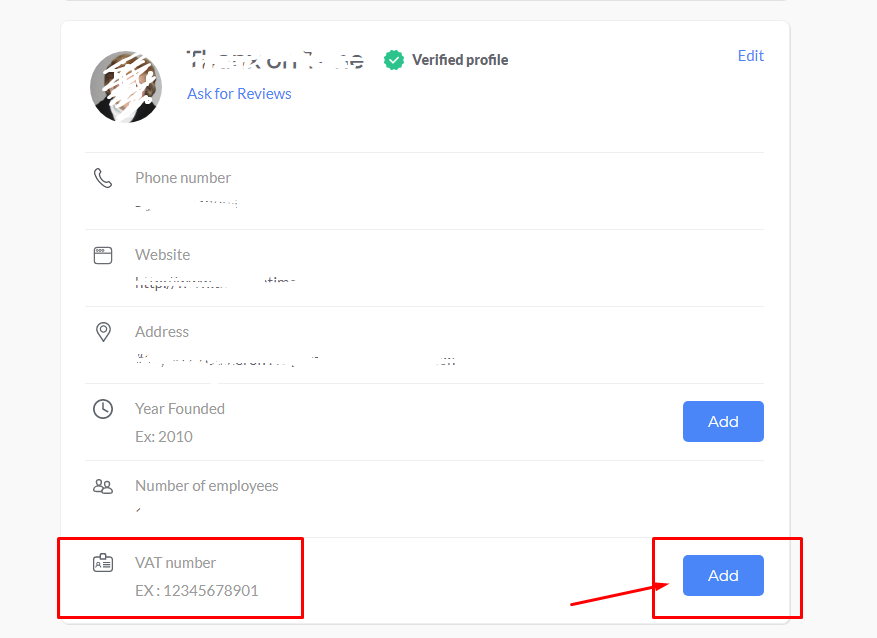

A small business (kleinunternehmer) that does not charge vat might not have a vat number. Select the country where the company is located, enter its vat number and click. When you get your vat number, you must put it in your impressum.

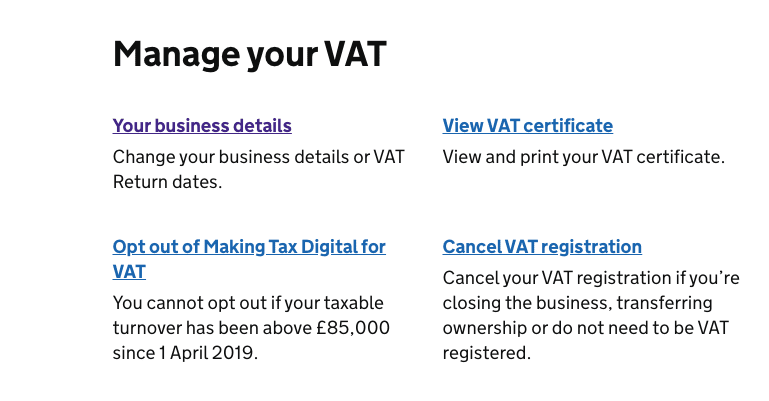

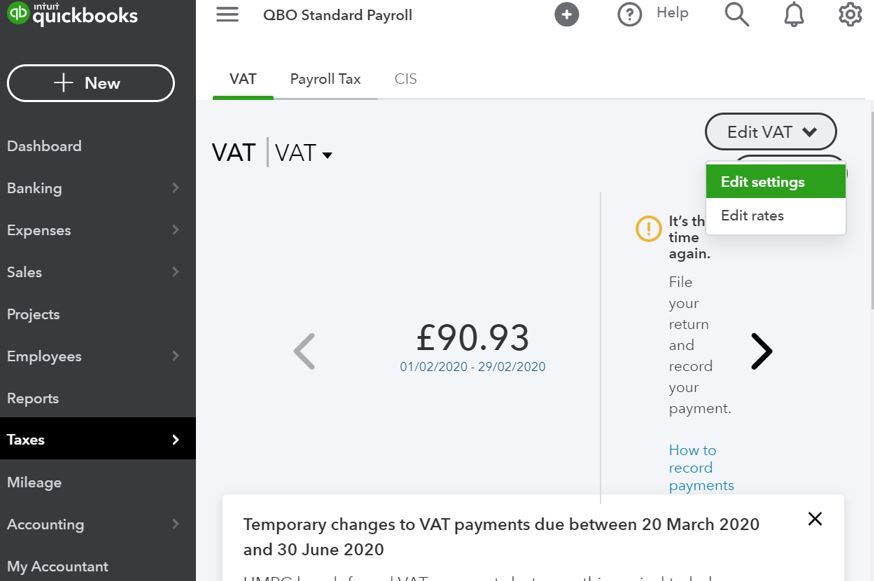

For example, french vat numbers begin with fr (followed by 9 digits), and in peru, the vat number begins with pe (followed by 11 digits). Calling the hmrc vat helpline hmrc has a complete database of vat. 1) calling the vat helpline of hmrc in case you have any doubt about a vat registration.

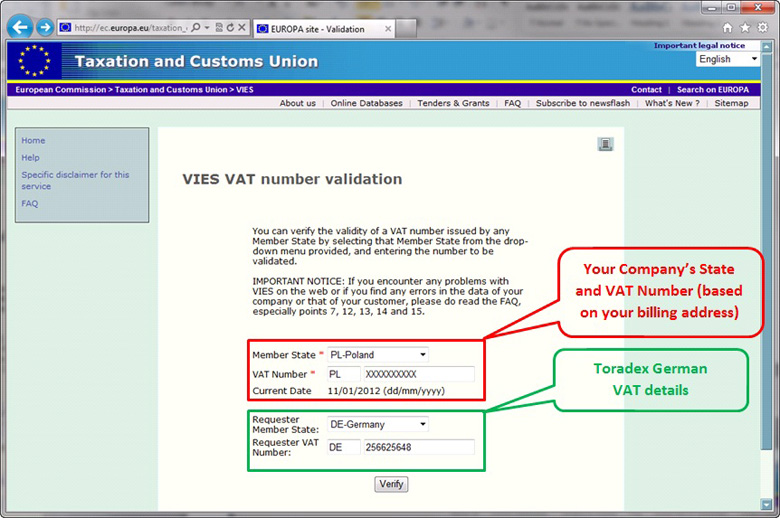

The following are the ways to check it is valid: Users must please note that the database is updated weekly. Head over to the european commission’s website and access vies vat number validation.

Use this service to check: The vat amount when removing vat (vat inclusive amount * vat rate) / (1 + vat rate) = vat amount taken away; It is usually located at the top or bottom of the page.

(£120.00 * 0.2) / (1 + 0.2) = £20.00 (vat amount taken away) a short. Use the vies website, an online vat checker for businesses in the eu. The vat number does not exist.

:filters:format(jpeg)/f/88751/3162x1704/8f7196b400/vat.png)