Exemplary Tips About How To Fix Your Credit Report

Lower your credit utilization ratio.

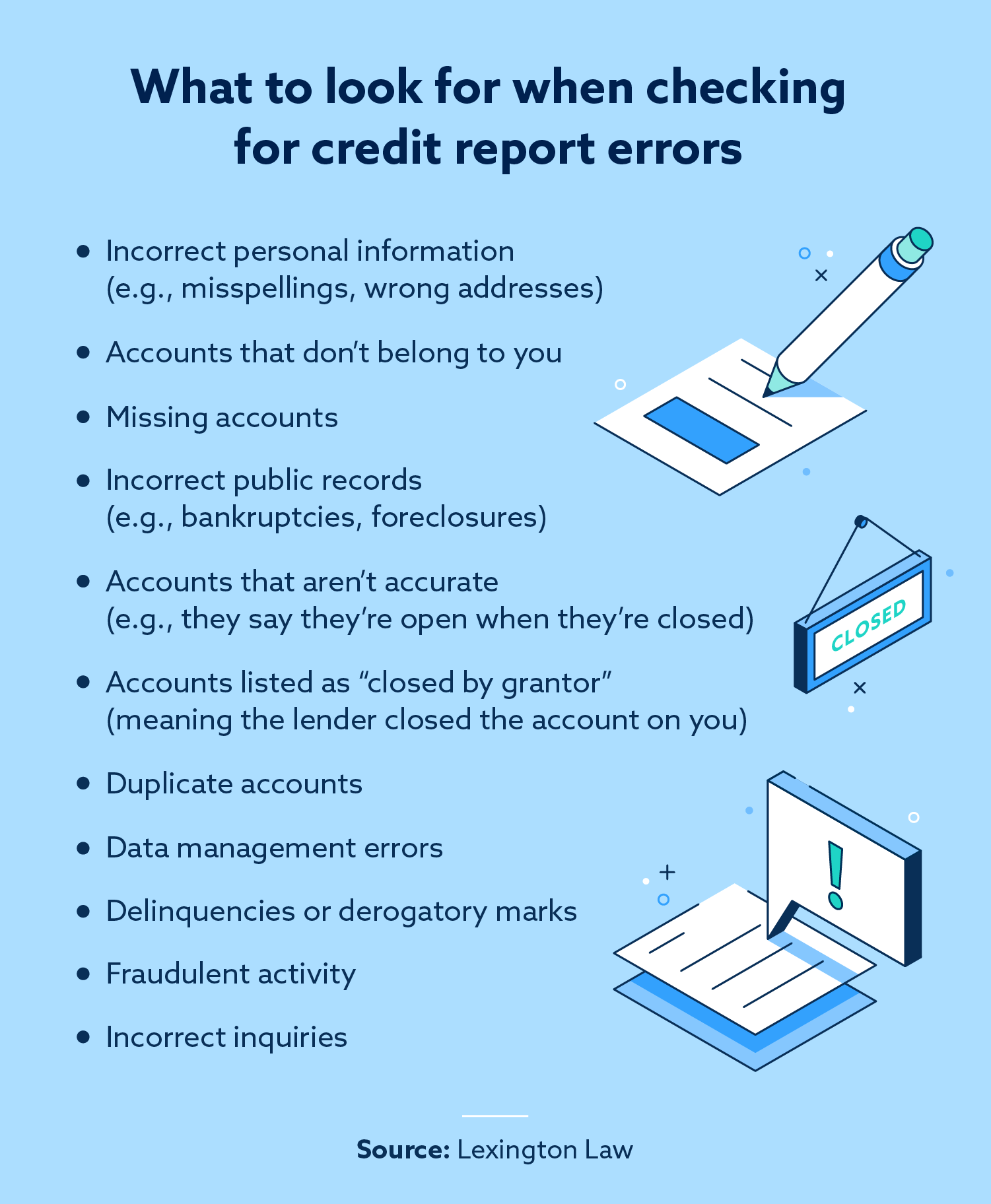

How to fix your credit report. Inaccurate information on your credit reports could hurt your credit score, and errors are not uncommon. The fair credit reporting act give you protections as to how quickly the dispute must be handled and a legal pathway to sue. Eric wilson law is tuscaloosa’s best debt relief agency.

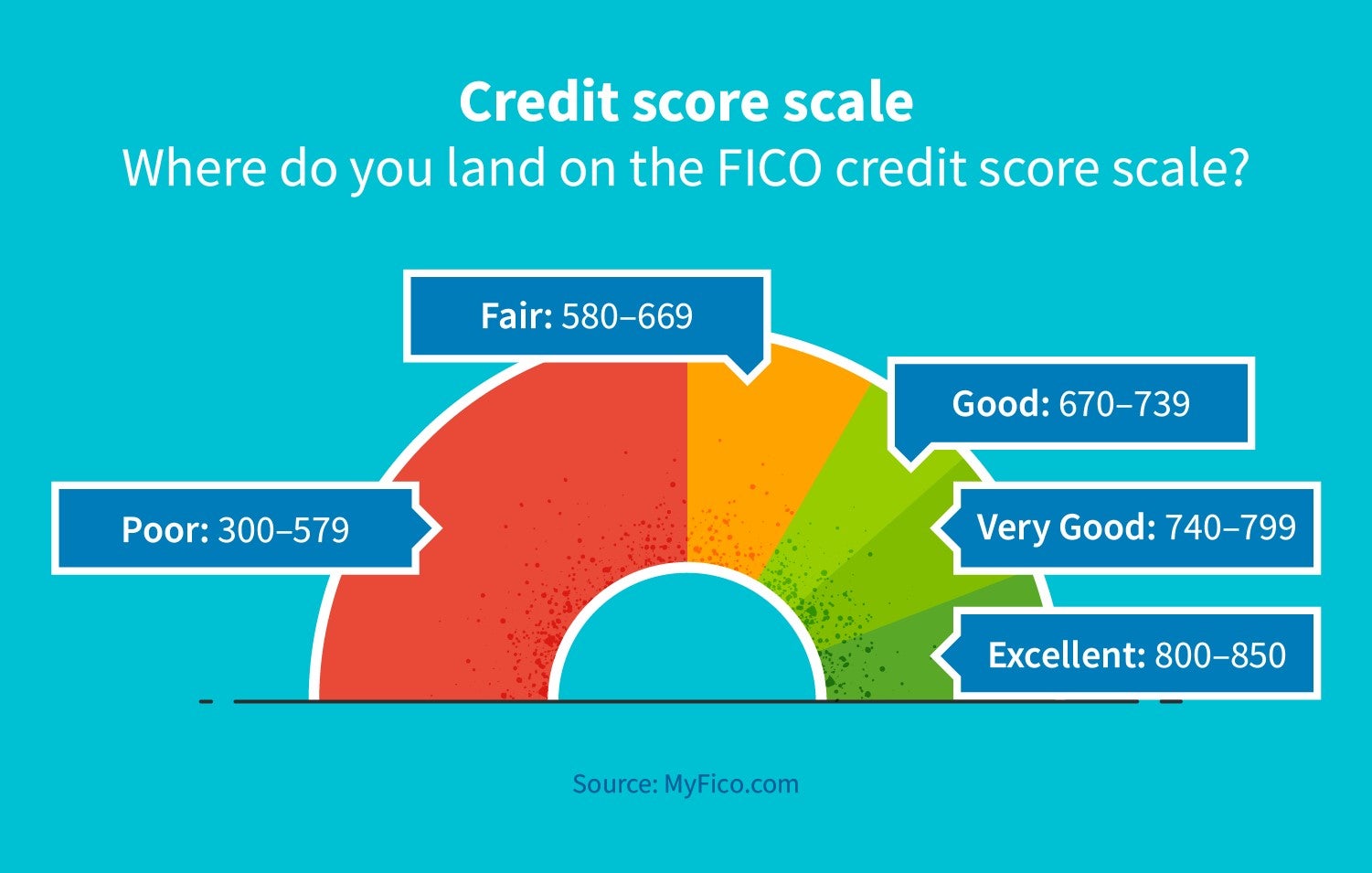

Here are tips on fixing your credit, while avoiding scams. If your credit score is closer to 1000, it means that. If you see mistakes in your report, contact the credit bureau and the company that provided the information.

Point it in the right direction with creditcompass™! These are some ways to improve your credit score over time: Go straight to the credit bureau, not to your creditor.

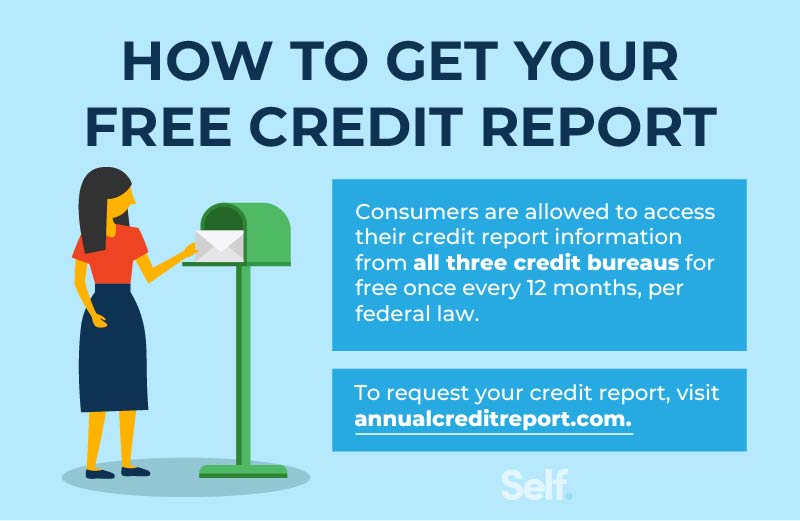

The most effective way to fix your credit report is to attack it from two directions: How to fix your credit in 7 easy steps 2. Annual credit report request servicep.o.

If your score is nearer to 2000, you're in the pink of financial health, with a low risk of default. Learn more about ways to help you rebuild your credit score. Dispute errors on your reports;

To improve your credit score, you need to know what it is. Get score planning & report protection tools now! Keep your credit utilization low;