Real Info About How To Reduce Tax Deductions

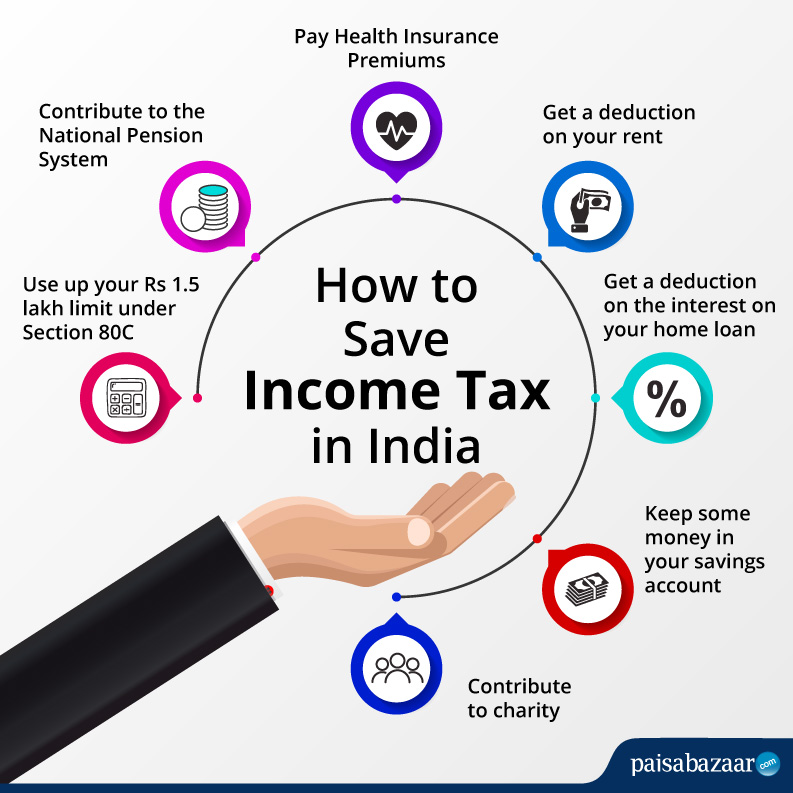

11 ways to reduce taxable income.

How to reduce tax deductions. Employees who do not itemize federal income taxes (and therefore did not deduct premiums paid) may reduce the taxable amount of pfl benefits by the value of premiums paid. See general information for details. First, divide your home office.

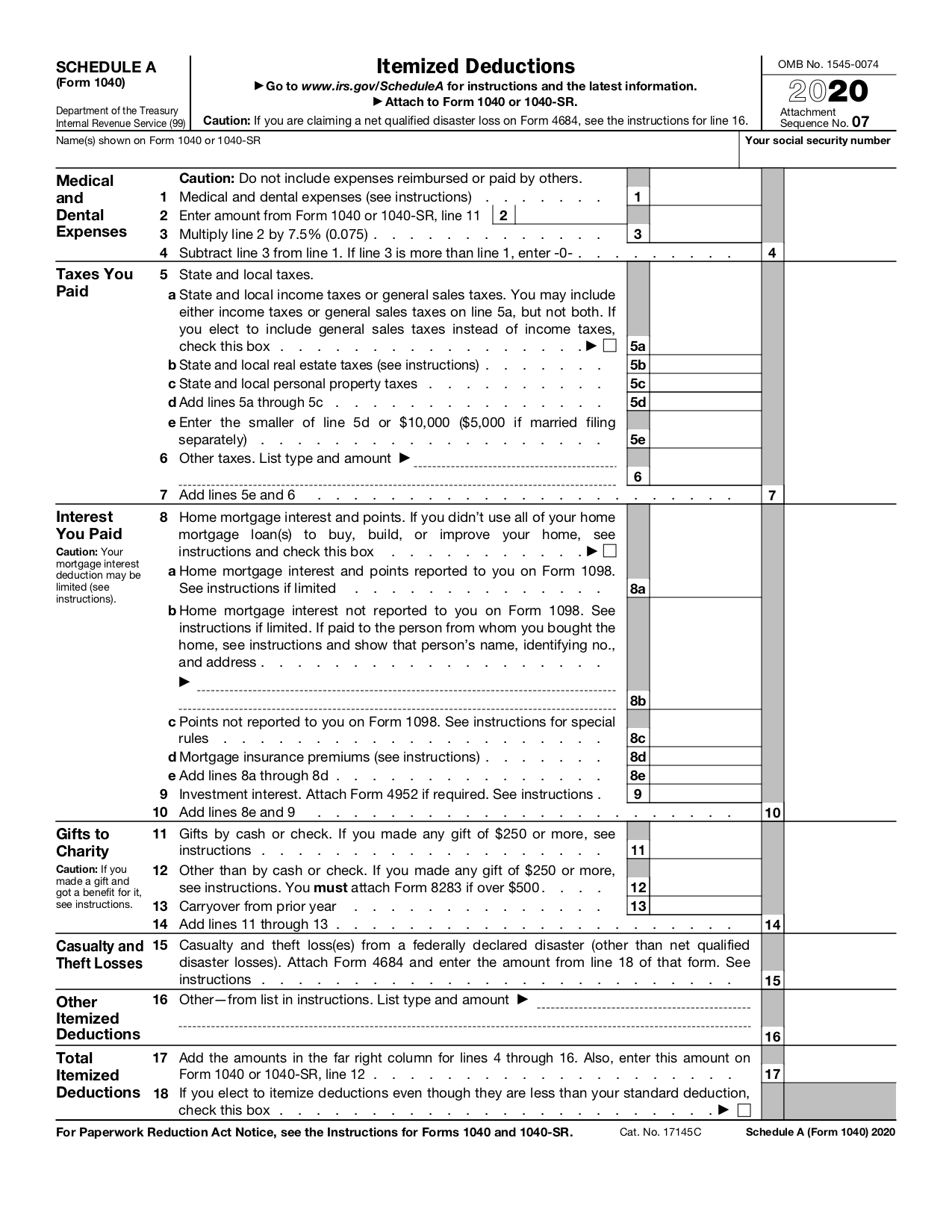

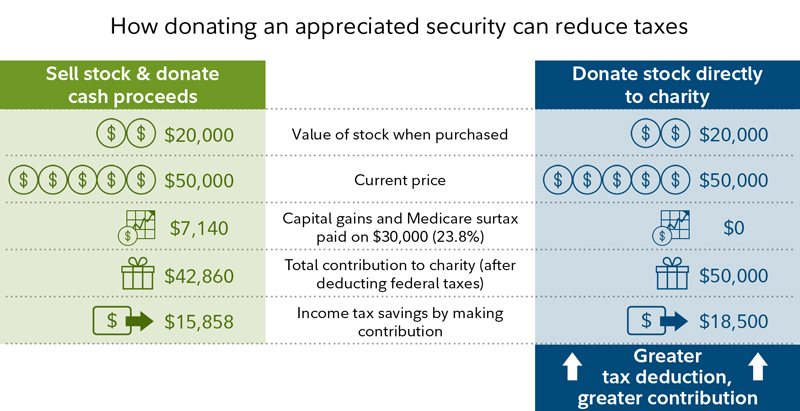

1 making a salary reduction contribution. Tax deductions decrease your tax burden by lowering your taxable income and you can either claim the standard deduction or itemize your deductions when you file. By claiming the child tax credit (ctc), you can reduce the amount of money you owe on your federal taxes.

How credits and deductions work. Not every dollar you spent on qualified deductions can be subtracted from your income to lower your tax bill. How do i deduct standard deduction from income tax?

The amount of your standard deduction depends on your filing status, age, and other factors. Description:tax deductions reduce your adjusted gross income or agi and thus your taxable income on your income tax return. As a result, your overall taxes reduce.

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. If you are an employee. For best results, download and open this form in adobe reader.

With this option, your tax deduction is based on the percentage of your home that your home office occupies. When hra is not a part of salary: How to reduce taxes on salary 1.