Awesome Tips About How To Improve Credit Score After Bankruptcy

Get more control over your financial life.

How to improve credit score after bankruptcy. Auto loans can also be very helpful in rebuilding your credit after filing for an arizona bankruptcy. Ad build your credit and increase savings with our unique credit building system. Never has debt relief been more helpful and never has great credit after bankruptcy been so easy to attain.

Your payment history makes up 35% of your credit score. Ad responsible card use may help you build up fair or average credit. How to improve your credit score after filing bankruptcy in michigan.

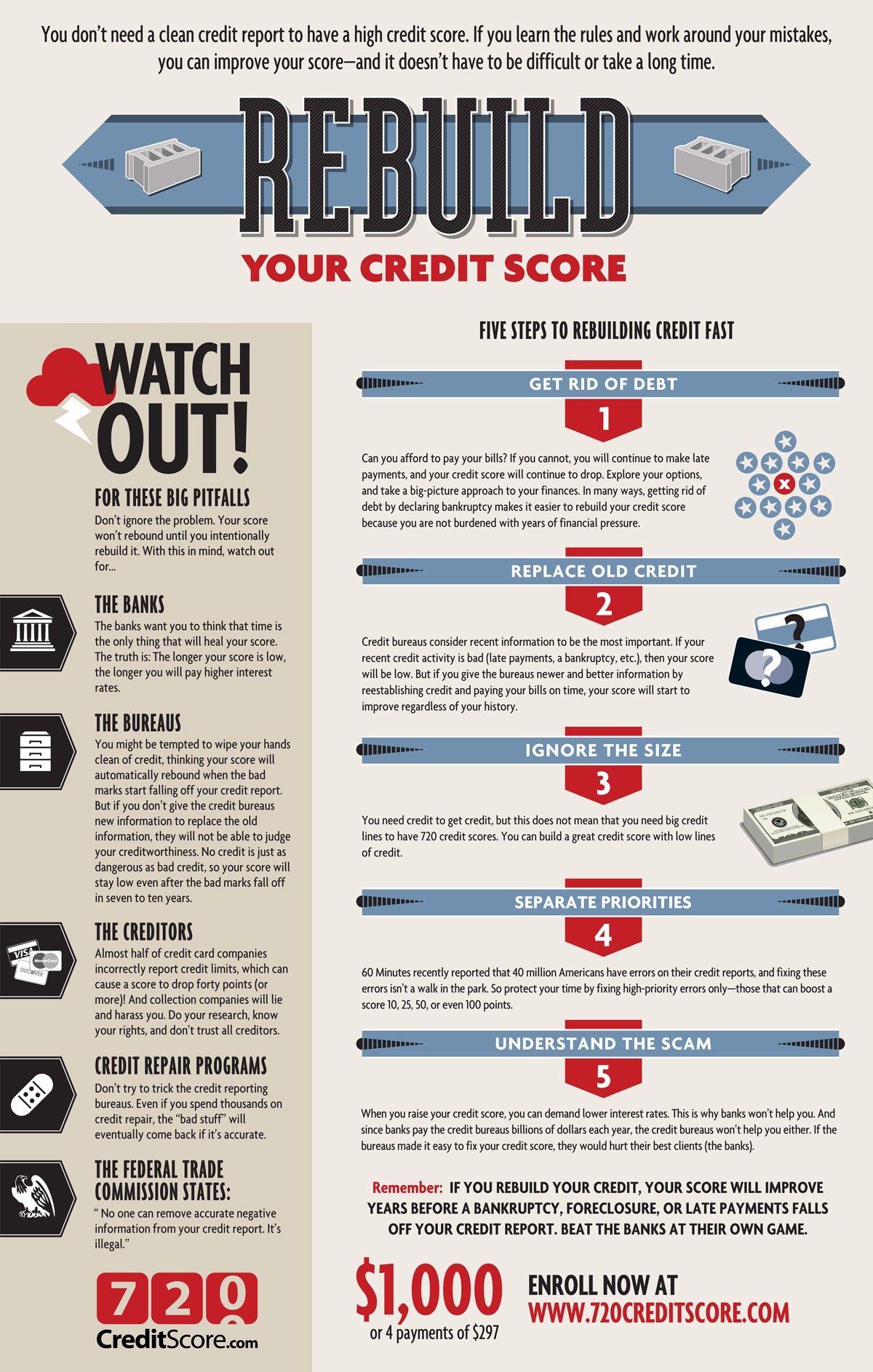

People who are interested in improving their credit scores after bankruptcy may opt for payroll deduction credit cards and secured credit cards. You can start rebuilding your credit score after the bankruptcy stay stops creditors from taking action. Improve your credit by up to 60 points.

Ad increase your credit scores & get credit for the bills you're already paying. To learn more about bankruptcy debt relief or your credit score after bankruptcy, call. Confirm with your bankruptcy attorney what your new payment will be after your bankruptcy is discharged, and do your best to make full and timely payments.

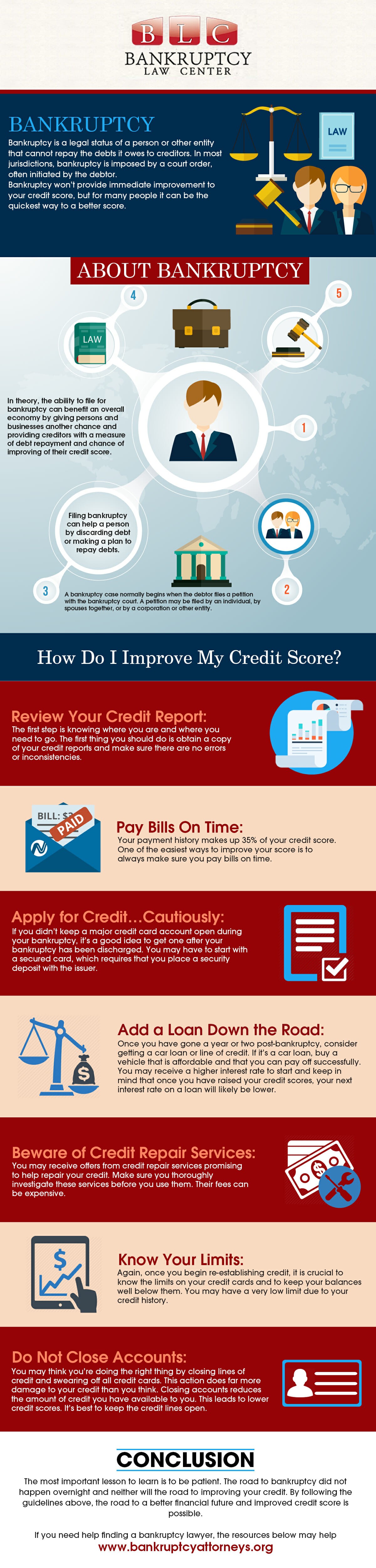

7 steps to improve your credit score after filing bankruptcy. Practicing good financial habits is the key to building excellent credit after a bankruptcy. Review your credit report the first step is knowing where you are and where you need to go.

(1) keep up with any debts that survived the bankruptcy filing. Find a card offer now. The more accounts you add, the faster you can replace those negative entries with positive ones, and the higher your credit score will rise.